The first quarter of 2024 represents the most robust quarter since the start of 2019. The S&P 500 Cap Weighted Index surged by 10.2%, marking its most significant quarterly gain since that year. Similarly, the Nasdaq Composite and the Dow Jones Industrial Average saw rises of 9.1% and 5.6%, respectively, with the latter breaking the 40,000 milestone for the first time. Mega-cap-weighted technology stocks are at the helm, a repeat of the A.I. rage in the markets’ upward trajectory last year.

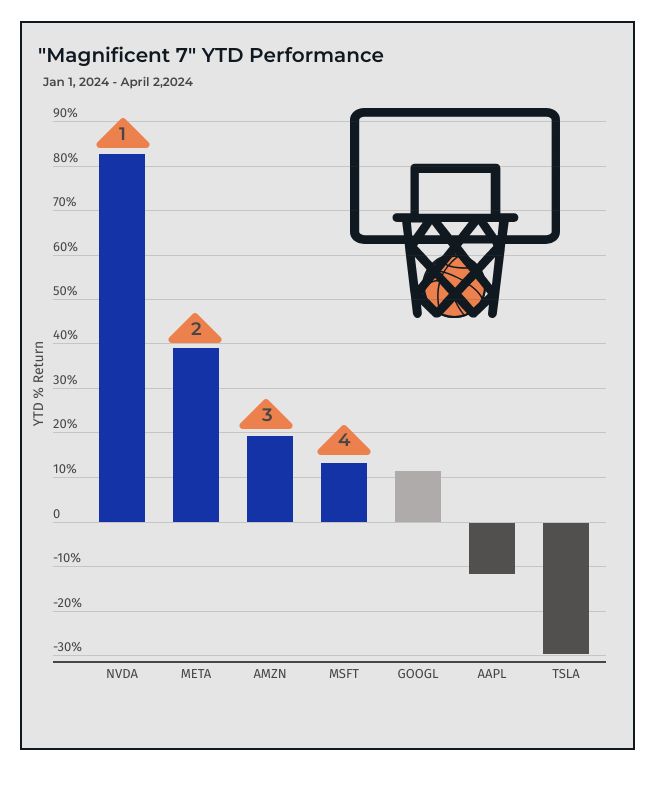

As the stock market hits record levels, a growing number of investors are wary about the potential for a bubble. Concerns center on inflated stock values and the risk of an exaggerated A.I. growth cycle. JP Morgan warns that the market’s heavy reliance on a select few could lead to a rapid unraveling. This worry aligns with the transition from the so-called ‘Magnificent 7’—Nvidia, Meta, Amazon, Microsoft, Alphabet, Apple, and Tesla—to the ‘final four’, a term from college basketball, highlighting Wall Street’s focus on Amazon, Meta, Microsoft, and Nvidia. These companies aren’t just participating in the market; they’re leading it and significantly influencing the S&P 500’s returns this year.

Our diversified approach to the financial markets shields vulnerability to drastic drawdowns tied to a handful of stocks. However, concerns arise as signs of vulnerability emerge, such as Apple and Tesla’s shares declining. This phenomenon, often called ‘flash crashes, ‘occurs when one fund’s decision to rebalance triggers a domino effect among others, leading to an accelerated sell-off. While we have exposure to these stocks, our approach is diversified enough to withstand this kind of scenario, mitigating the potential risks associated with concentrated investments.

Navigating the Bull with Eyes Wide Open

The first quarter of 2024 has proven to be extraordinary for the U.S. financial markets, greatly attributed to the Federal Reserve’s supportive policy stance. Echoing the previous year, there has been a significant influx of investment into technology and AI companies. However, the best news is a broadening of the rally to include more sectors. While bonds have shown a more measured performance, lacking substantial upward movement, they continue to provide a reliable income for investors.

The U.S. economy continues to be a major force in global growth. Wall Street giants such as Goldman Sachs and Bank of America remain optimistic about the stock market’s future, predicting a continued bull run with potentially significant gains.

The Relative Strength Index (RSI), a key technical indicator, showcases promising signs of an enduring upward market trend. This metric, devised by J. Welles Wilder Jr., oscillates between 0 and 100, measuring the velocity of price movements. It is a critical tool for traders and investors, pinpointing overbought conditions when above 70 and oversold situations when below 30. Not only does the RSI facilitate the identification of potential market reversals, but it also confirms existing trends, supporting informed trading decisions. The RSI’s consistent position above 50 for nearly 100 trading days bolsters confidence in the market’s strength. Sustained high reading suggests a bullish trend will likely continue, signaling an anticipated upward trajectory in the market.

Riding the wave of soaring equity markets is thrilling, but staying grounded is crucial. We can’t help but take a cautious approach with the market’s valuations in the top 10% historically. With the stock market’s robust performance boosting the value of American retirement accounts, we’re seeing a surge in 401(k) millionaires and record-high average account balances. However, now is not the time for complacency. As we embark on Q2 2024, we face the future with a balanced approach of optimism and caution, ready to pivot and seize the opportunities that present themselves.